Bangalore: EQBAC, a global B2B investment platform designed exclusively for financial advisors and wealth managers, has officially launched operations in India. Built for the next generation of cross-border investing, EQBAC gives Indian partners plug-and-play access to international assets including fractional global equities, ETFs, Mutual funds, bonds, pre-IPOs, and structured products, all through one secure and regulated digital platform.

Founded by financial services veteran Satinder Aggarwal, EQBAC is already licensed in Mauritius and active across the UAE and now India. Its entry into the Indian market comes at a time when both retail and HNIs are increasingly seeking exposure to global markets, but find themselves limited by fragmented systems, complex compliance, or product restrictions.

“EQBAC isn’t just another investing platform. We’re not in the direct-to-consumer space, and we never plan to be,” said Satinder Aggarwal, who has spent over 25 years building regulated financial businesses across India and the Middle East. “This is a platform built around our partners. Our goal is to support advisors, not compete with them.”

EQBAC positions itself as a pure-play execution broker, not a distributor or advisor. The platform allows distributors to fully retain client relationships, revenue, and branding. EQBAC charges no cut of distributor earnings and offers complete fee transparency. White-label options and embedded APIs make it easy for partners to integrate the infrastructure into their own offerings.

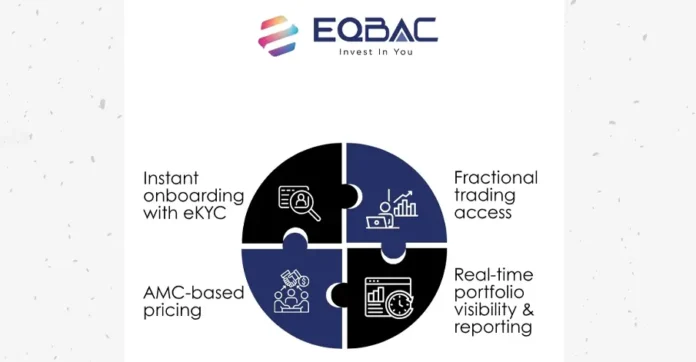

The platform helps advisors solve some of their biggest headaches including onboarding, compliance, custody, execution, reporting, multiple terms of business and white labelling across both Indian and offshore markets. All investments are held in segregated client accounts, with custody through top global banks like Citibank, Standard Chartered, and State Bank of Mauritius. For Indian investors, EQBAC offers access to global exchange markets and regulated platforms like BSE StAR MF, smallcase, and UnlistedKart.

Importantly, EQBAC lets Indian retail and HNI clients invest in global assets fractionally. This kind of access was previously reserved only for ultra-wealthy clients. Through integrated partners like GTN, clients can now buy shares in global companies and ETFs without the high minimum ticket sizes, which often exceeded $50,000. It makes premium global investing more practical for everyday investors, while compliance, KYC, and settlement stay streamlined through EQBAC’s back-end infrastructure.

For advisors, EQBAC offers a full set of tools to manage onboarding, trade execution, portfolio insights, compliance, and post-trade reporting. There’s no need to deal with backend complexity. The platform supports CRS reporting, real-time AML checks, white-labeled client dashboards, and secure digital onboarding. It’s also built to support clients in the US and other tightly regulated markets.

“Distributors told us they wanted better control, not another platform chasing their clients,” Aggarwal added. “They wanted global access, seamless execution, and someone who understands what working behind the scenes really means. That’s exactly what EQBAC was built to do.”

India marks the next chapter in EQBAC’s growth strategy. The company plans to onboard 150+ partners across the country by March 2026, targeting wealth firms, independent advisors, fintechs, wealth techs and even traditional brokers looking to expand their global offering. It also plans to grow Assets Under Custody to $500 million over the next two years by scaling its B2B integrations and deepening product access.

EQBAC is also investing in its India advisory and compliance team to ensure partners have hands-on support. Strategic partnerships with global custodians, digital KYC providers, fund houses, and GIFT City-aligned investment structures are already in place.

As India’s financial market grows, EQBAC offers what advisors and investors have been waiting for. It gives them global access that works the way it should. No clutter. No conflict. Just a clean and secure platform that lets professionals focus on doing their job well.

For partnership inquiries, media interviews, or platform demos, visit www.eqbac.com.