As digital ecosystems become more interconnected, trust is emerging as a critical differentiator for brands and platforms. Consumers increasingly expect digital experiences that are secure, seamless and personalised — without being intrusive. Looking ahead to 2026, two key developments are redefining how organisations build this trust: biometric-led authentication in payments and AI-driven intelligence transforming loyalty programs.

Biometrics Redefining Payment Security

The payments landscape is witnessing a decisive move away from passwords and static PINs toward biometric-first authentication frameworks. With regulatory focus intensifying around stronger digital payment authentication, the industry is prioritising security models that are both robust and frictionless.

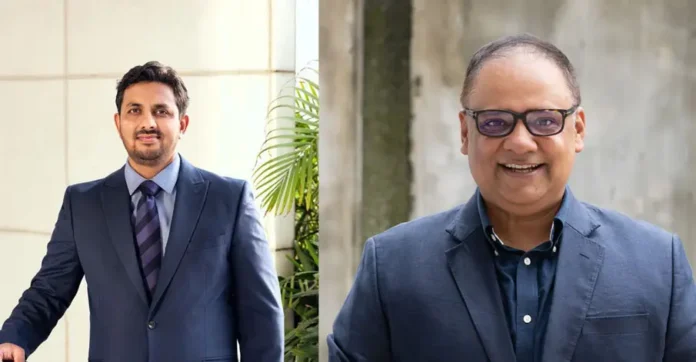

According to Shailesh Paul, CEO of Wibmo, a PayU company, biometric authentication is becoming central to how digital trust is established at scale. By placing biometrics at the core of identity verification and combining it with risk-based authentication, payment platforms can dynamically assess transaction context and user behaviour in real time. This approach not only strengthens fraud prevention but also improves customer experience by reducing unnecessary friction during transactions.

As digital payments continue to expand across devices and channels, biometric-led authentication is emerging as a foundational layer for scalable, trust-driven payment ecosystems — one that aligns regulatory compliance with user convenience.

AI Transforming Loyalty into Continuous Engagement

In parallel, loyalty programs are undergoing a structural transformation. Traditional, points-based models are giving way to intelligent ecosystems focused on continuous, personalised engagement across the customer journey.

Dhruv Verma, Founder and CEO of Thriwe, highlights that loyalty in the coming years will be driven by AI-powered personalisation engines that can interpret real-time customer signals. These systems enable brands to move beyond rigid, rule-based frameworks and instead deliver tailored rewards, communication and nudges based on individual preferences, behaviour and context.

With the rise of agentic recommendation capabilities, loyalty platforms are becoming more adaptive and responsive. This allows brands to build stronger emotional connections with customers, positioning loyalty as a long-term driver of brand affinity rather than a short-term incentive mechanism.

Building Intelligence-Led, Trust-Centric Experiences

Together, these shifts reflect a broader evolution in digital experience design. Security and engagement are no longer isolated functions; both depend on intelligent systems that operate contextually and in real time. Biometric authentication strengthens trust at the transaction level, while AI-powered loyalty enhances relevance and continuity across interactions.

As consumer expectations rise and digital regulations evolve, organisations that successfully integrate biometric security with AI-driven engagement will be better positioned to deliver secure, meaningful and scalable digital experiences. The future of digital payments and loyalty will belong to platforms that embed trust, intelligence and adaptability at the core of their ecosystems.