The trust gap

Banking is at a pivotal moment. Customers now expect instant, seamless experiences. Regulators demand real-time oversight and tighter controls. Fintech challengers are proving every day that speed and safety can coexist. Yet many banks remain tethered to batch-driven cores that were built for an overnight settlement world, when “fast” meant “next day,” not “next second.”

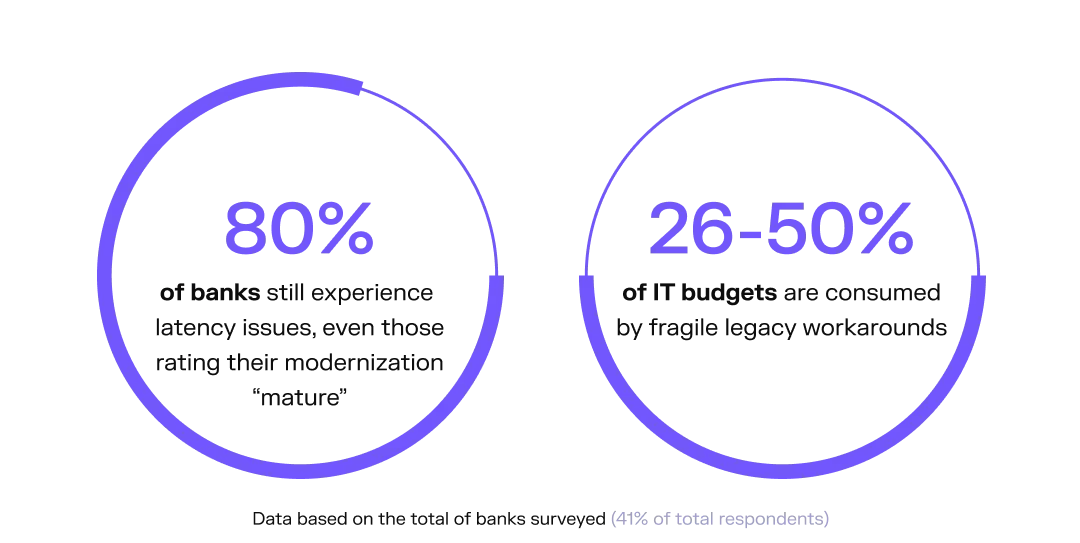

The consequences are real and costly. Eighty percent of banks still experience latency issues, even those that describe their modernization as “mature.” Between a quarter and half of IT budgets are swallowed by fragile legacy workarounds. And those inefficiencies strike at the very moments where trust is earned or lost: fraud detection delayed by minutes instead of milliseconds, onboarding journeys that stall before customers even begin, product launches that lag behind digital-first competitors, and everyday customer experiences where personalization misfires or alerts arrive too late. Latency is no longer just a technology problem. It is a trust problem.

- 80% of banks still experience latency issues, even those rating their modernization “mature.”

- 26–50% of IT budgets are consumed by fragile legacy workarounds

Latency impacts where it matters most:Fraud detection. Delayed signals expand exposure windows.Onboarding. Activation delays sour first impressions.Product launches. Bottlenecks let digital challengers move first.Everyday CX. Missed personalization and delayed alerts erode trust.

Latency impacts where it matters most:Fraud detection. Delayed signals expand exposure windows.Onboarding. Activation delays sour first impressions.Product launches. Bottlenecks let digital challengers move first.Everyday CX. Missed personalization and delayed alerts erode trust.

Latency is no longer just a technology problem. It is a trust problem.

Why AI raises the stakes

Artificial intelligence has become a strategic priority across the industry, but it is not a shortcut to modernization. It is an amplifier. When deployed on brittle systems, AI magnifies weaknesses instead of creating value. Nearly half of banks report that they have fully deployed AI across critical functions, and another 44 percent are piloting. Yet more than half say that AI has significantly increased pressure on their infrastructure, exposing gaps in governance, speed, and reliability.

AI’s potential upside is enormous when it is paired with real-time pipelines and strong governance. It can deliver hyper-personalized experiences that deepen customer relationships, predictive fraud detection models that operate in milliseconds, and faster development cycles that bring products to market before challengers can respond. But without modernization, the same initiatives backfire. Offers arrive too late to resonate, risk models generate false confidence, and customers feel unseen. As one industry leader put it:

AI’s potential upside is enormous when it is paired with real-time pipelines and strong governance. It can deliver hyper-personalized experiences that deepen customer relationships, predictive fraud detection models that operate in milliseconds, and faster development cycles that bring products to market before challengers can respond. But without modernization, the same initiatives backfire. Offers arrive too late to resonate, risk models generate false confidence, and customers feel unseen. As one industry leader put it:The modernization playbook

The banks that are pulling ahead understand that modernization is not about ripping out the core. It is about modernizing with precision. Batch systems still have their place in stable, low-risk back-office operations. But critical customer-facing workflows demand real-time augmentation.

Leading institutions are decoupling high-speed services from their legacy cores, leveraging fintech partnerships to plug in proven real-time capabilities, and adopting API-first architectures that allow them to integrate new services quickly and securely. They are embedding governance-first design to ensure that data is accurate, explainable, and audit-ready. And they are building AI-ready, low-latency data layers that turn artificial intelligence into a multiplier rather than a stressor. This dual-layer approach, preserving batch where appropriate while layering in real-time where speed and trust are critical, delivers stability without sacrificing innovation.

Lloyds Banking Group has taken a progressive approach to modernization by standing up a parallel, cloud-based core alongside its legacy systems. This allows the bank to launch new products at speed while continuing to rely on its traditional batch-driven systems for stable, low-risk operations—an example of how incremental core augmentation can balance innovation with resilience.

HSBC co-developed an AI-powered anti-money-laundering platform with Google that analyzes transaction patterns and networks in real time. Results reported publicly: 2–4× more true positives while cutting alert volumes by ~60%, showing how a fintech/big-tech partnership can materially upgrade real-time financial-crime controls.

DBS launched what it called the world’s largest banking API developer platform, going live with 50+ collaborations at launch. The bank uses APIs to plug partners in quickly and co-create products, evidence that an API-first backbone speeds integration and time-to-market.

The cost of delay

The cost of inaction compounds quarter after quarter. Forty-one percent of banks spend up to half their IT budgets just keeping old systems alive, and more than half report a heavy internal resource drain on workaround engineering. Every dollar spent maintaining fragile systems is a dollar not spent on innovation. Every quarter of delay widens the gap with fintechs, deepens technical debt, and chips away at customer trust.

Confidence is no protection either. Sixty percent of banking leaders describe themselves as “very confident” in their AI readiness, yet eighty percent still experienced latency failures in the past year. The gap between perception and performance is growing more expensive by the day.

The path forward

Five steps to real-time readiness

Modernization creates conditions for accelerated revenue growth and smarter operational decisions. Less friction leads to more opportunities. That said, precise execution is critical.

If we were building your transformation strategy, here’s where we’d start:

Leadership priorities are aligned with this approach. A third of institutions cite AI readiness as their top modernization driver, followed by customer experience improvements and cost savings. Modernization is no longer a technical aspiration; it is a strategic mandate tied directly to growth.

Conclusion: Trust at speed

Banks remain the anchors of financial trust. But in today’s competitive and regulatory environment, trust demands speed, clarity, and control all at once. The leaders of the next decade will not simply be those with the newest technology. They will be the ones who modernize with intelligence: stabilizing what works, evolving what does not, and building platforms for continuous innovation.

Trust has become the new currency of banking. Real-time modernization is how institutions will earn it—and how they will keep it.