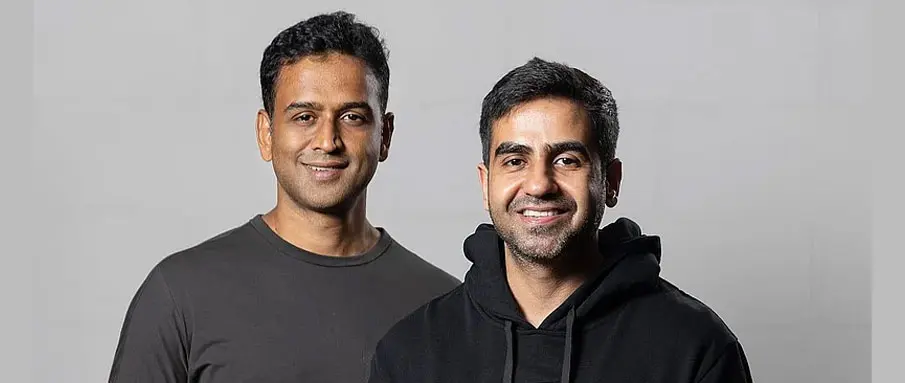

Nithin and Nikhil Kamath, co-founders of Zerodha, have invested ₹250 crore in InCred Holdings, securing a minority stake in the fintech firm. The move comes as InCred prepares for a ₹4,000–₹5,000 crore IPO, with a projected valuation of $1.8 billion to $2.5 billion.

Commenting on the investment, Nikhil Kamath said:

“India’s credit ecosystem is changing fast, more formal, more digital, and more accessible. InCred Group seems to get that. They’ve built a strong team, a technology-first approach, and a clear view of where the market is headed. Backing them is a bet on that broader shift—and the belief that responsible lending can scale without losing sight of fundamentals.”

Founded by Bhupinder Singh, InCred operates as a tech-driven non-banking financial company (NBFC), serving consumers, SMEs, and education borrowers. Its digital-first strategy combines proprietary risk analytics, data science, and technology-led operations to reach a broad base of retail and MSME customers.

The InCred Group comprises three verticals:

- InCred Finance (consumer, SME, and education lending)

- InCred Capital (wealth and asset management, capital markets, M&A advisory, equity research, and broking)

- InCred Money

To date, InCred Finance has raised over $370 million, including $60 million in Series D funding, which catapulted the company into the unicorn club. InCred Capital, its financial services arm, has also secured $50 million, largely backed by Indian family offices.

The Kamath brothers’ backing signals growing investor confidence in the digital lending space, especially as the sector undergoes rapid transformation and formalization driven by fintech innovation and evolving regulatory norms.