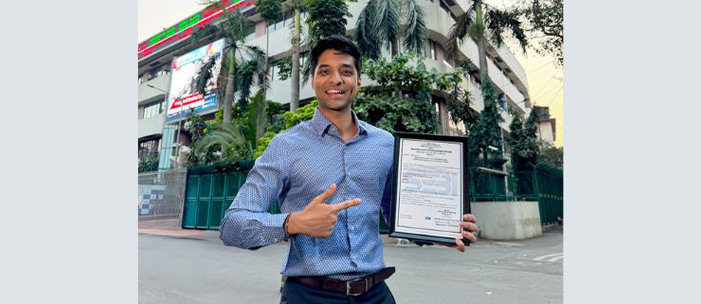

Sharan Hegde’s 1% Club has achieved a groundbreaking milestone by becoming the first finfluencer-led company in India to secure the SEBI-registered Investment Adviser (RIA) license. This development marks a significant shift in the financial advisory landscape, blending influencer-driven financial education with regulatory-backed investment advisory services.

With the RIA license, 1% Club is now authorized to provide personalized one-on-one financial planning services to its members. This regulatory approval is a major step towards enhancing transparency and trust in influencer-led financial advisory, ensuring that investment recommendations are in the best interest of clients. SEBI’s stringent regulations mandate that RIAs uphold fiduciary responsibility, which means clients receive unbiased, ethical, and well-informed financial guidance.

The rise of finfluencers in India has brought financial awareness to millions, but concerns around misinformation and lack of accountability have persisted. By securing an RIA license, 1% Club is setting a precedent for responsible financial content creators who aim to provide more than just generalized financial knowledge. The move not only legitimizes its services but also signals a shift toward greater compliance and professionalization in the influencer-led fintech space.

Looking ahead, 1% Club plans to expand its footprint across major Indian cities, addressing the growing demand for certified financial advisors. India has a glaring shortage of professional financial planners, and with the increasing complexity of personal finance, individuals are seeking trusted sources for investment and wealth management guidance. By merging content-driven financial education with personalized advisory, 1% Club is well-positioned to fill this gap.

As regulatory oversight continues to shape the fintech industry, Sharan Hegde’s venture is poised to set new benchmarks in ethical and transparent financial advisory services. The move underscores the importance of compliance in the evolving landscape of financial influencers, paving the way for a more structured and accountable ecosystem.