With the aim of becoming a regional and eventually a global digital leader, India is embarking on new milestones every month, launching technology advancements. The month marked the country’s first digital rupee pilot project for the wholesale segment. This milestone comes subsequent to India’s launch of 5G the previous month, indicating an integrated approach towards digital adoption across financial innovation and connectivity. Digital rupee is essentially the accepted version of cryptocurrency, launched by the Reserve Bank of India.

What is digital rupee?

Formally known as the central bank digital currency (CBDC), digital rupee is a legal tender in a digital format. It is being seen as an additional currency option, not different from the banknotes currently in use, other than being digital in nature and easier to use. In fact, it is the same as fiat currency and will be exchangeable against the same. Thus, digital rupee is primarily the digital avatar of the paper currency. It will be issued by the RBI and will have the same function as paper currency and will not be a decentralized asset like cryptocurrency. Some of the key features of digital rupee include:

- Its acceptance among all citizens, private enterprises and government organizations as a payment medium or a value store

- Ability to convert digital rupee into cash or commercial money

- No need to open a separate bank account

- Ability to reduce the cost of issuance and transactions

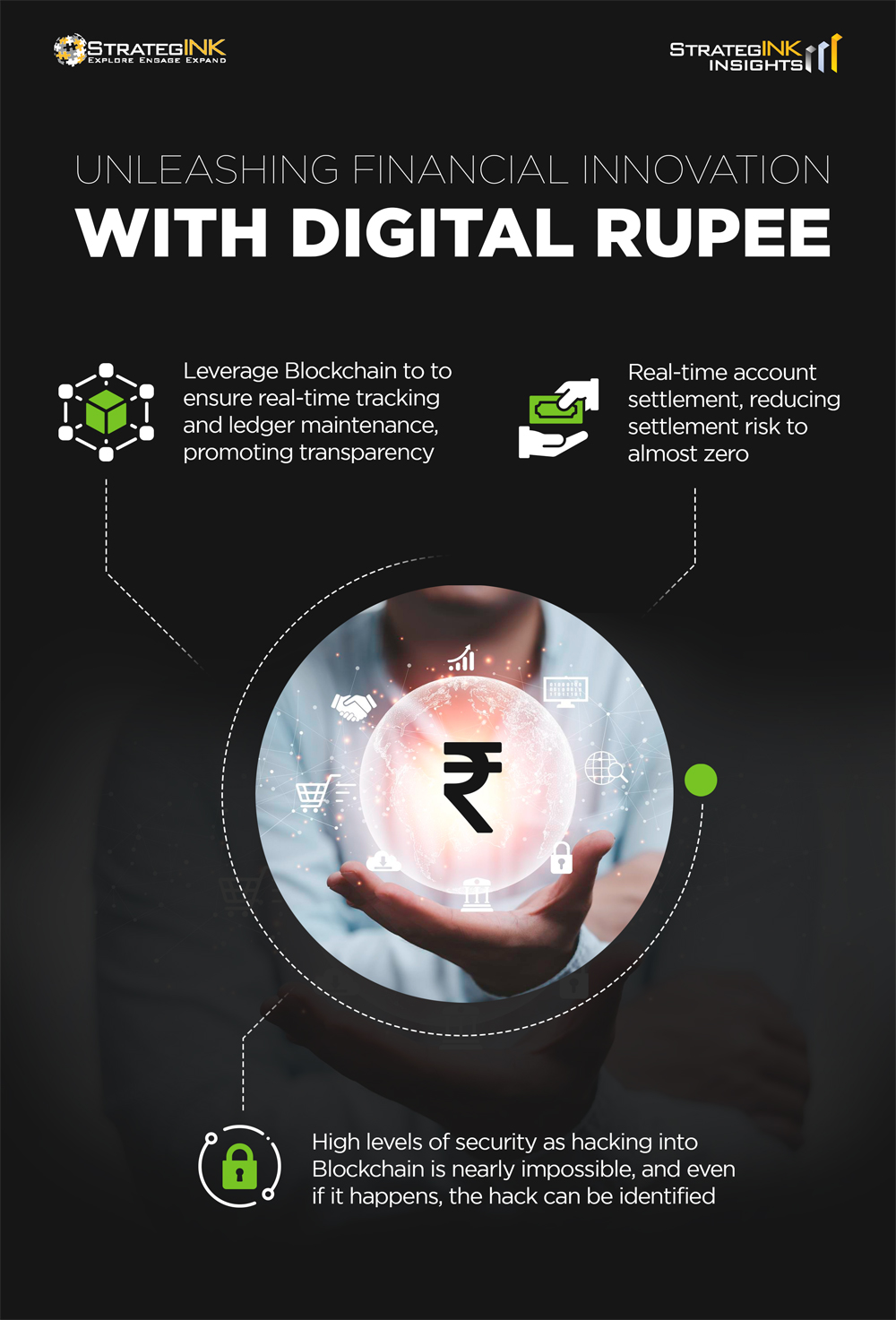

Unleashing financial innovation with digital rupee

With digital transformation and innovation becoming the key tenets of financial growth in the country, digital rupee is being heralded as an enabler to bolster India’s digital economy. digital rupee seeks to achieve the twin goals of enhancing financial inclusion and increasing the efficiency of monetary and payments systems. It will achieve the same by optimizing transaction costs, facilitating cross-border payments and reducing the carbon footprint by reducing the need to print paper notes.

There are several ways in which digital rupee will bolster the Indian economy and simultaneously garner higher technology adoption facilitating financial innovation:

In addition to these and other benefits, potential for innovation also comes from the indirect route of distribution of digital rupee. While RBI will be the sole authority for issuing digital rupee, its distribution will likely be taken up by private institutions, thus fostering a whole new wave of innovation in the financial ecosystem. As the rise of e-payments and BHIM gave birth to a whole set of solutions like Google Pay, PayTM, etc, in the country, digital rupee can also be expected to spearhead innovation.

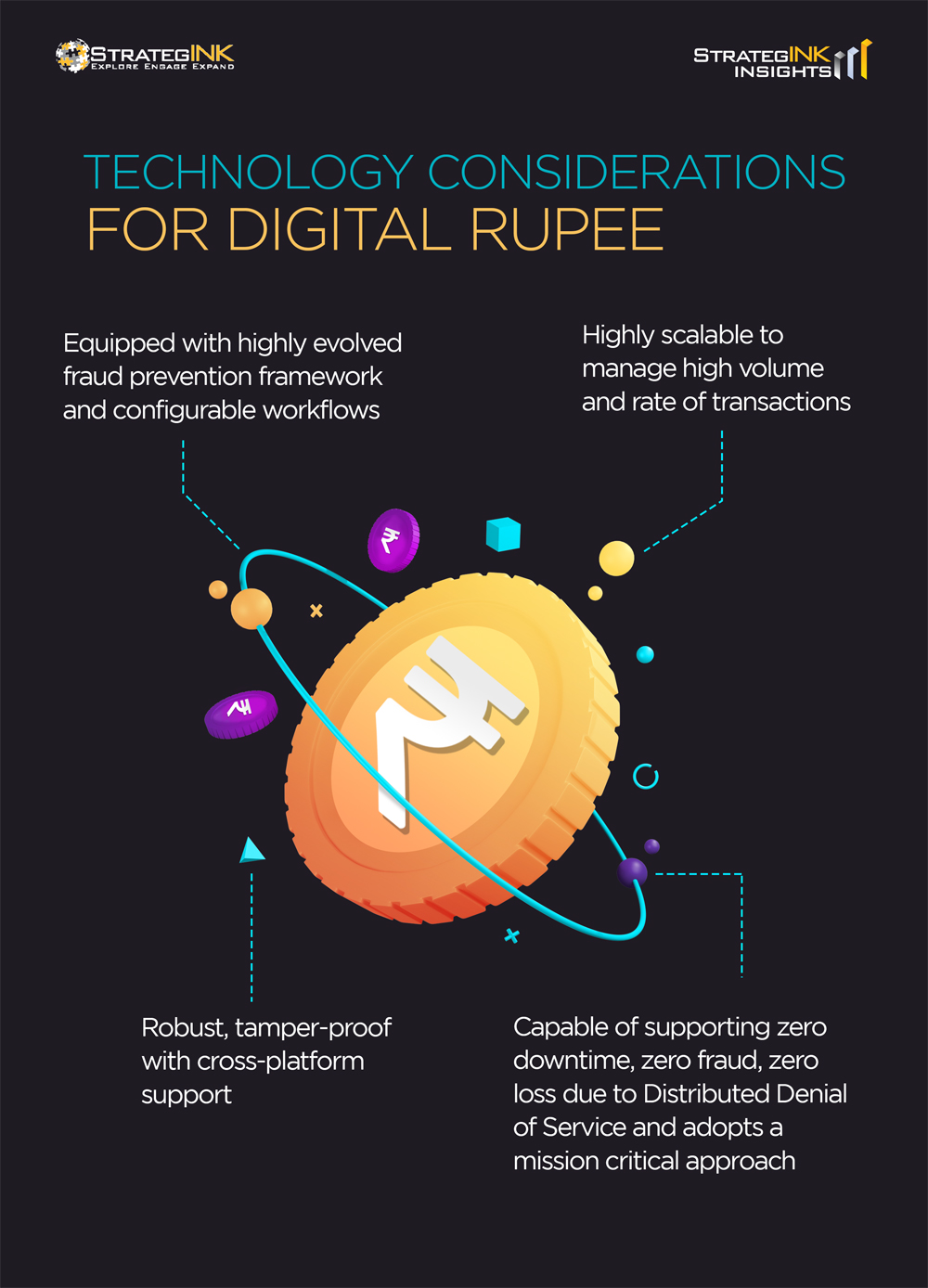

Technology considerations for digital rupee

With technology being at the core of digital rupee success, several technology considerations have been put in place to achieve high impact as detailed in the concept note released by the RBI, ensuring strong cybersecurity, technical stability and resilience with a platform which is:

What’s next in digital rupee?

The launch of digital rupee is taking place in two phases. Currently, the wholesale transaction phase for large transactions for specific financial institutions has been initiated as a pilot project. However, soon, its retail counterpart for public transactions will also come under circulation. Digital rupee will follow the principle of anonymity for smaller transactions and of trace for larger transactions. The transactions will be facilitated by a public and private key to ensure high levels of security.

While there are several questions that still need to be answered, the launch of digital rupee has unlocked new potential and opportunities for the country. It has been instrumental in illustrating how digital transformation holds the key towards unparalleled growth and development to help the country position itself as a global technology leader.