With 40% smartphone penetration, better logistics and seamless e-payment facilities, the e-commerce market in Thailand saw a 28% increase last year and is expected to reach a market value of US$6000 million+(214 billion Thai Baht) by 2023. While the country had an inclination and commitment to boost e-commerce for the past few years, the pandemic played an integral role in accelerating the adoption and change of behavior towards online shopping. On the one hand, there has been large scale acceptance and demand for e-commerce by the population of the country. On the other hand, the government is also focusing on greater internet penetration and boosting e-payment acceptance to further accelerate the e-commerce push. These two forces together are expected to help Thailand cross the US$30 billion mark by 2025 for its e-commerce market.

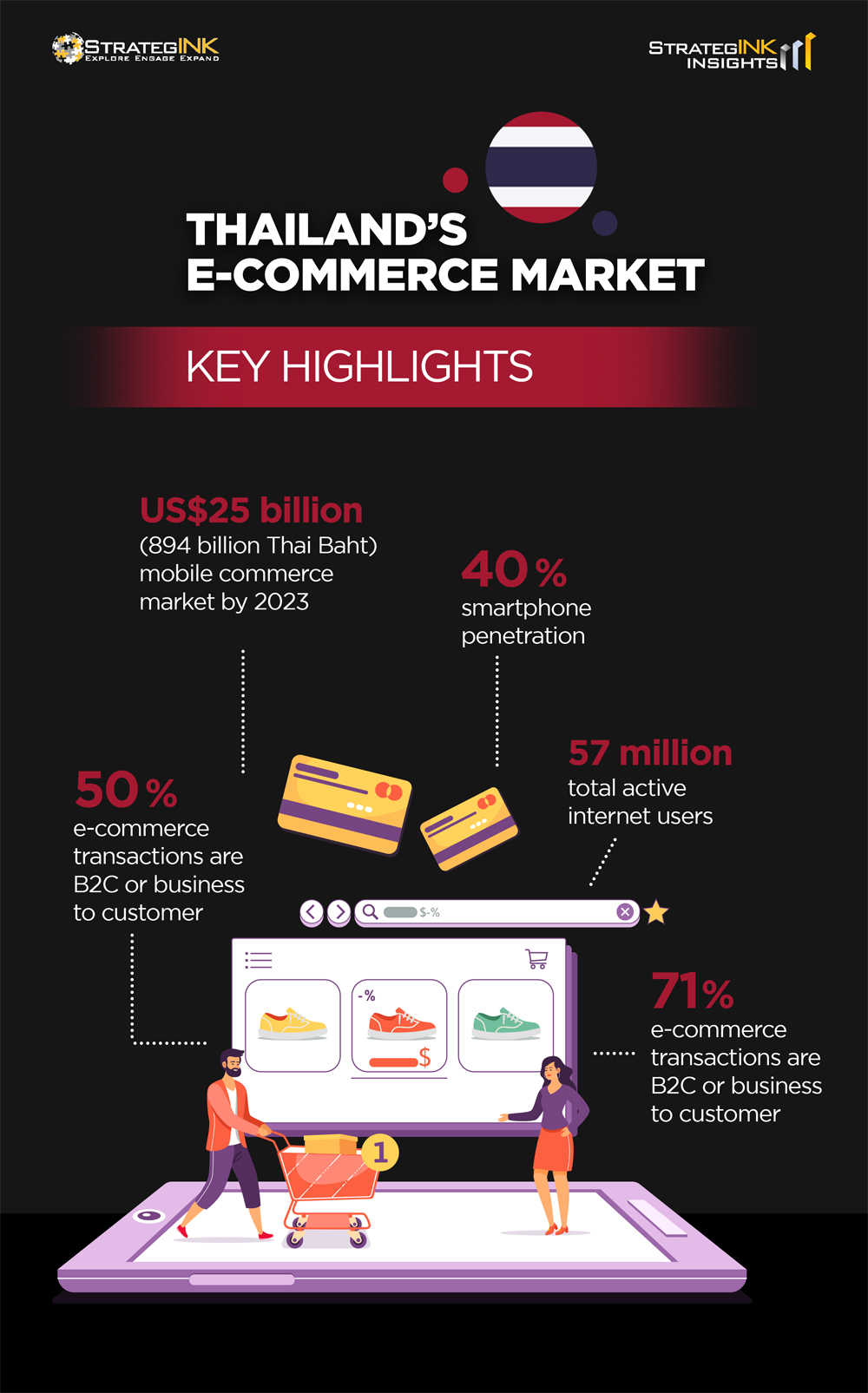

Thailand’s e-commerce market: Key highlights

What’s driving e-commerce growth in Thailand?

With technology becoming the mainstay for Thailand across different sectors, the country has been proactive in adopting digital advancements which have been reflected in the tremendous growth of e-commerce. Some of the top driving factors include:

E-commerce push in Thailand 4.0

The country launched Thailand 4.0 economy model to transition from a production based to a knowledge/ services based economy. Here, technology is expected to play a leading role in enabling this transition. An integral part of the same is the national e-commerce plan, where e-commerce is being seen as a driving force to achieve Thailand’s digital economy and trade. Some of the key targets for e-commerce with a government push are:

- US$150 billion (5.35 trillion Baht) as e-commerce revenue by 2022

- 10 million online buyers

To facilitate the same, the country is investing in greater internet penetration, encouraging e-payment adoption to boost a digital economy, with each initiative having a specific plan under the Thailand 4.0 mission.

Growing internet and mobile-first population

With 82% internet penetration and a large population base falling in the millennial category, Thailand is witnessing a rapid increase in the internet savvy and mobile-first generation. This growth is translated to the consumers shopping behavior where they are showing an inclination towards the e-commerce option.

E-commerce foreign investments

Thailand’s e-commerce market boom and expanding potential has made the country an attractive foreign investment proposition for global e-commerce giants. E-commerce has been one of the leading sectors when it comes to receiving foreign investments for Thailand. For instance, Chinese giants, Alibaba and JD.com, both have invested in the Thai e-commerce market, considering the exponential scope for the ROI.

Opportunities for digital innovation with e-commerce growth

Growth in the e-commerce industry in Thailand is driving digital innovation for different sectors of the economy. On a closer look, one can consider e-commerce as the driving force behind large scale digital transformation in the country, pushing both businesses and consumers towards greater digital adoption.

E-payments and financial innovation

As e-commerce continues to grow, online payments, especially the mobile payments industry is likely to boom with digital interventions. Gradually, consumers will begin to prefer digital modes of payment to be more convenient and will give a push to financial innovation in the country for payment portals and platforms. Digital wallets and financial infrastructure for payments is thus receiving a boost.

Growth of apps

With this growing mobile-first generation who browse most e-commerce platforms on their phones, mobile applications are likely to see a boost. Since applications have a better interface and user experience than websites on mobile phones, the rise of e-commerce coupled with growing mobile-first generation open up a plethora of opportunities for tech entrepreneurs to experiment with shopping apps.

Innovation in digital marketing and social commerce

Thailand has a total of 50 million+ active social media users and a rise in social commerce where consumers get influenced for purchasing decisions through social media platforms is on the rise. This clearly indicates that with the right disruption, businesses can leverage digital marketing to promote social commerce as a part of the growing e-commerce sector, to attract more consumers.

Disruption in logistics

Tech enabled and smart logistics and transportation comes as a direct by product of e-commerce industry expansion. As the number of online orders are increasing, there is a need to supplement the shipping of the same, which will be virtually impossible with leveraging technology. Therefore, tracking, monitoring, faster delivery, etc. are all different digital innovation areas in logistics and transportation that e-commerce growth is bringing along.

Greater business digitization and digital inclusion

Finally, a greater demand from consumers for e-commerce is necessitating a push for businesses to go digital as a means for survival. Thus, most businesses in Thailand are now striving to build a digital presence, facilitating digital inclusion and bridging the digital divide at the economy level.

E-commerce as an enabler for Thailand 4.0

Invariably, it is quite evident that the e-commerce industry is being seen as a promising driver for Thailand 4.0, enabling the country to move from a production based to a knowledge based economy. While skepticism towards e-payments, limited infrastructure coverage, etc, might require additional efforts, the country is already on a fasttrack to deal with them. This e-commerce growth will not only fuel digital innovation in other sectors but will also serve as a push for bridging the digital divide and can enable a digital-first future for Thailand.

Stay tuned to this space to know more about the latest developments and insights on the technology landscape of Thailand and other ASEAN countries.