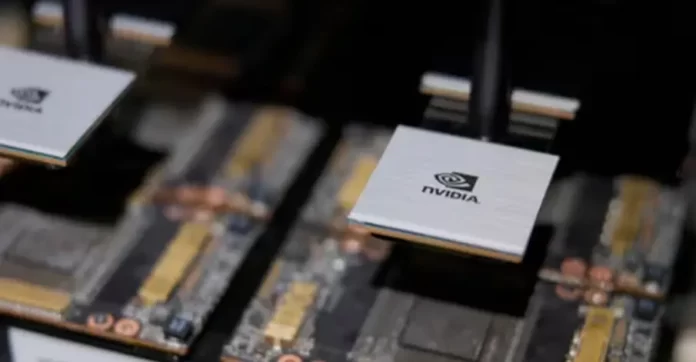

The recent AI surge sees significant interest from the Gulf, with Saudi Arabia and the UAE rapidly acquiring Nvidia’s processors. Both nations are purchasing numerous H100 units, according to the Financial Times, intensifying their AI objectives.

In the startup ecosystem, where much AI innovation occurs, the short supply of these GPUs has led prominent venture capitalists to fear their startups lagging. Consequently, they’ve begun purchasing these units whenever possible.

Conversely, The Verge highlighted that CoreWeave, supported by Nvidia, used its H100 GPUs as a guarantee to obtain a $2.3 billion loan, aiming to acquire more H100s.

Given the high demand, Reuters indicated in June that US sanctions, which bar the export of Nvidia’s premium chips to China and Hong Kong, resulted in a black market for these chips.

This fervor over the past few months, described by Elon Musk as enthusiasm from “everyone and their dog”, reflects the race to harness the technology propelling AI advancements.

Earlier in April, Insider mentioned Musk’s acquisition of about 10,000 GPUs for his AI-centric endeavors to morph X into a multipurpose application. Musk has also revealed his own AI enterprise, xAI, posing as an alternative to OpenAI.

This intense scramble to secure chips for advanced AI underscores their undeniable value.

While OpenAI’s chatbot has indeed been a hallmark of modern AI, Nvidia’s processors, central to its rise to a $1 trillion valuation in May, promise longevity that ChatGPT currently lacks. Moreover, there’s been criticism regarding its declining quality.

The frenzy is set to escalate. Nvidia recently introduced the GH200, an advanced version of the H100, expected to debut in the upcoming year’s second quarter.